7 Order 2019 was also gazetted to provide income tax exemption to small medium enterprises SME on their export sales. Additional exemption of RM8000 disable child age 18 years old and above not married and pursuing diplomas or above.

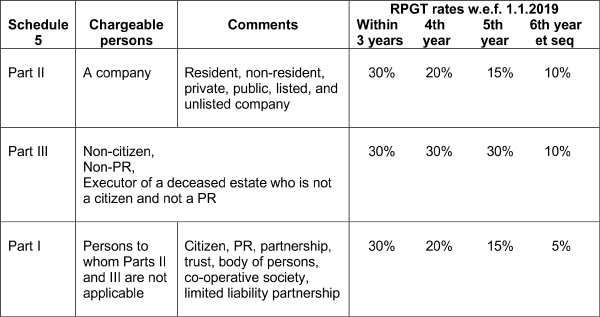

Real Property Gains Tax Part 1 Acca Global

Corporate tax highlights.

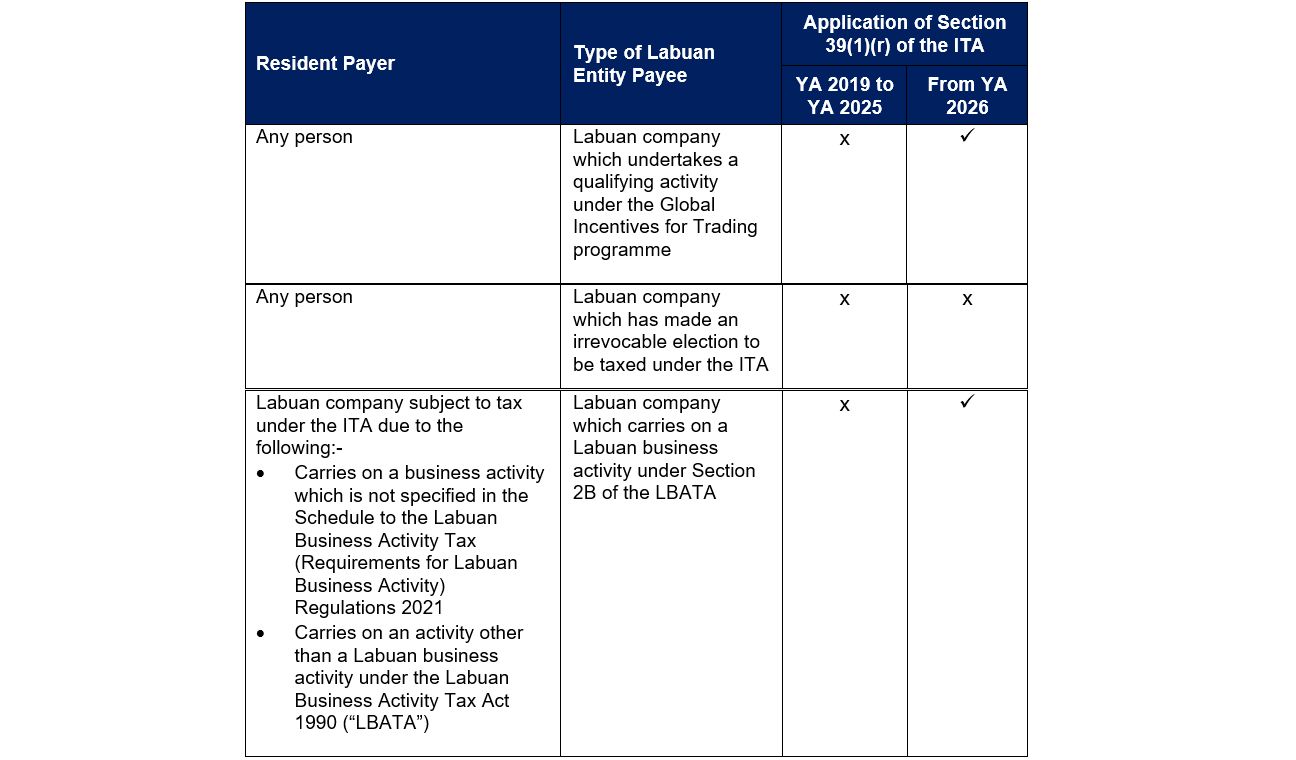

. Import Duty and Sales Tax Exemption on KN95 Type Face Mask. Adequate number of full-time. 10 December 2019 Page 1 of 42 1.

These measures would be effective as from the entry into force of the Finance Act 2019. The Income Tax Exemption No. 102019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication.

4 Order 2019 was gazetted which grants an income tax exemption for certain payments by Malaysian resident individuals. Receiving tax exempt dividends. Malaysia only on 26 February 2019 to provide guidance in the application of stamp duty relief.

25062019 Guide on Sales Tax Exemption Under Schedule A for Item 33a33b556364 65. On the first 5000. Here are the income tax rates for personal income tax in Malaysia for YA 2019.

On 28 May 2019 the Income Tax Exemption No. Coronavirus Disease 2019 Covid-19 Restricted to 1000 9. A resident company incorporated in Malaysia with an ordinary paid-up share capital of RM25 million and below.

A Limited Liability Partnership LLP resident in Malaysia with. 4 Order 2019 was gazetted which grants an income tax exemption for certain payments by Malaysian resident individuals to nonresidents. Chargeable Income RM Calculations RM Rate Tax RM 0 5000.

2 Order 2019 the Order was gazetted on 27 February 2019. Malaysias 2019 Budget will see an increase in stamp duties to 4 from 3 for transfer of real properties that are RM1 million and higher. More 66.

There will be a two. On 28 May 2019 the Income Tax Exemption No. Objective The objective of this Public Ruling PR is to explain -.

Alongside those Orders Income Tax Exemption No. The existing tax exemption for interest earned on wholesale money market funds will cease with effect from 1 January 2019.

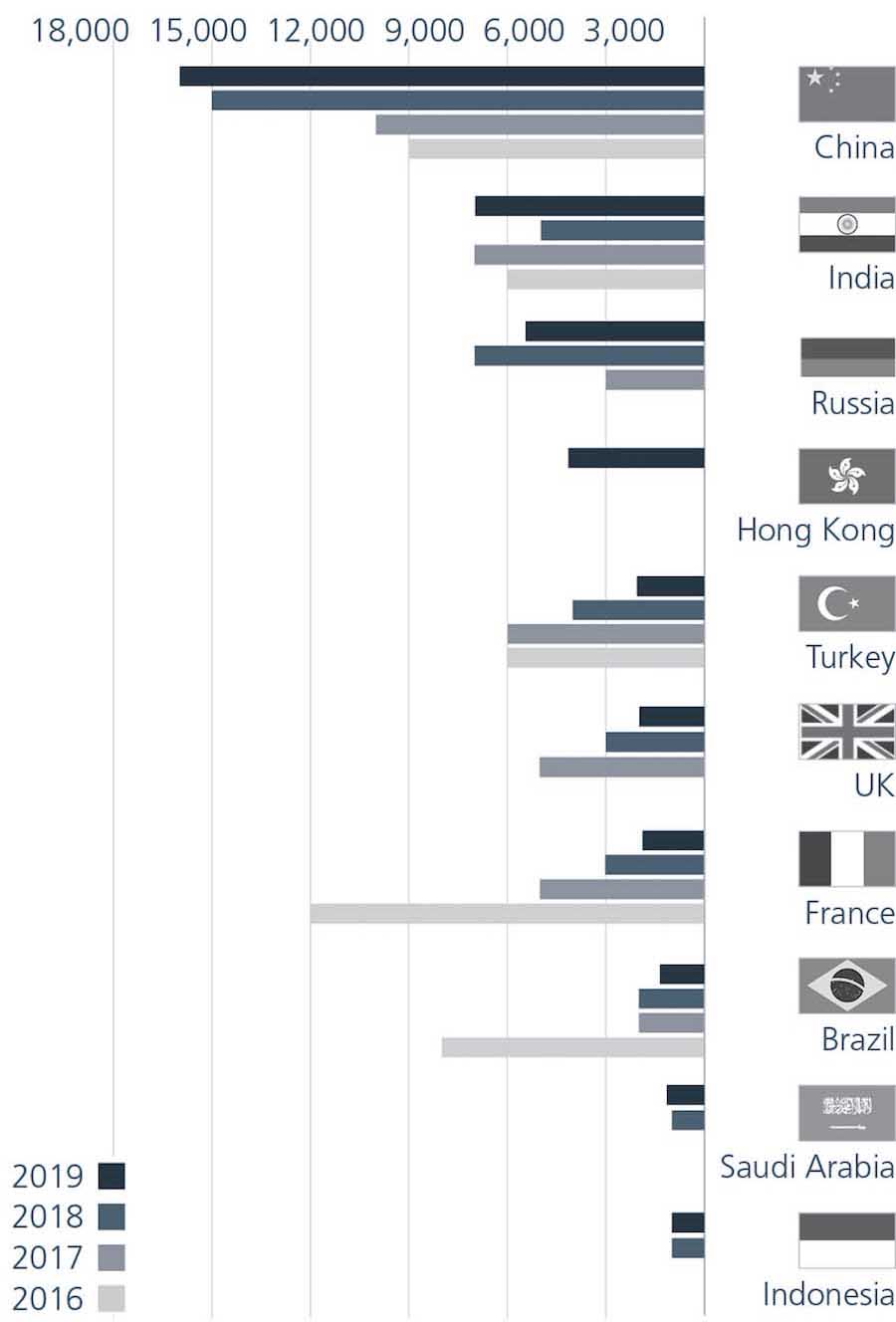

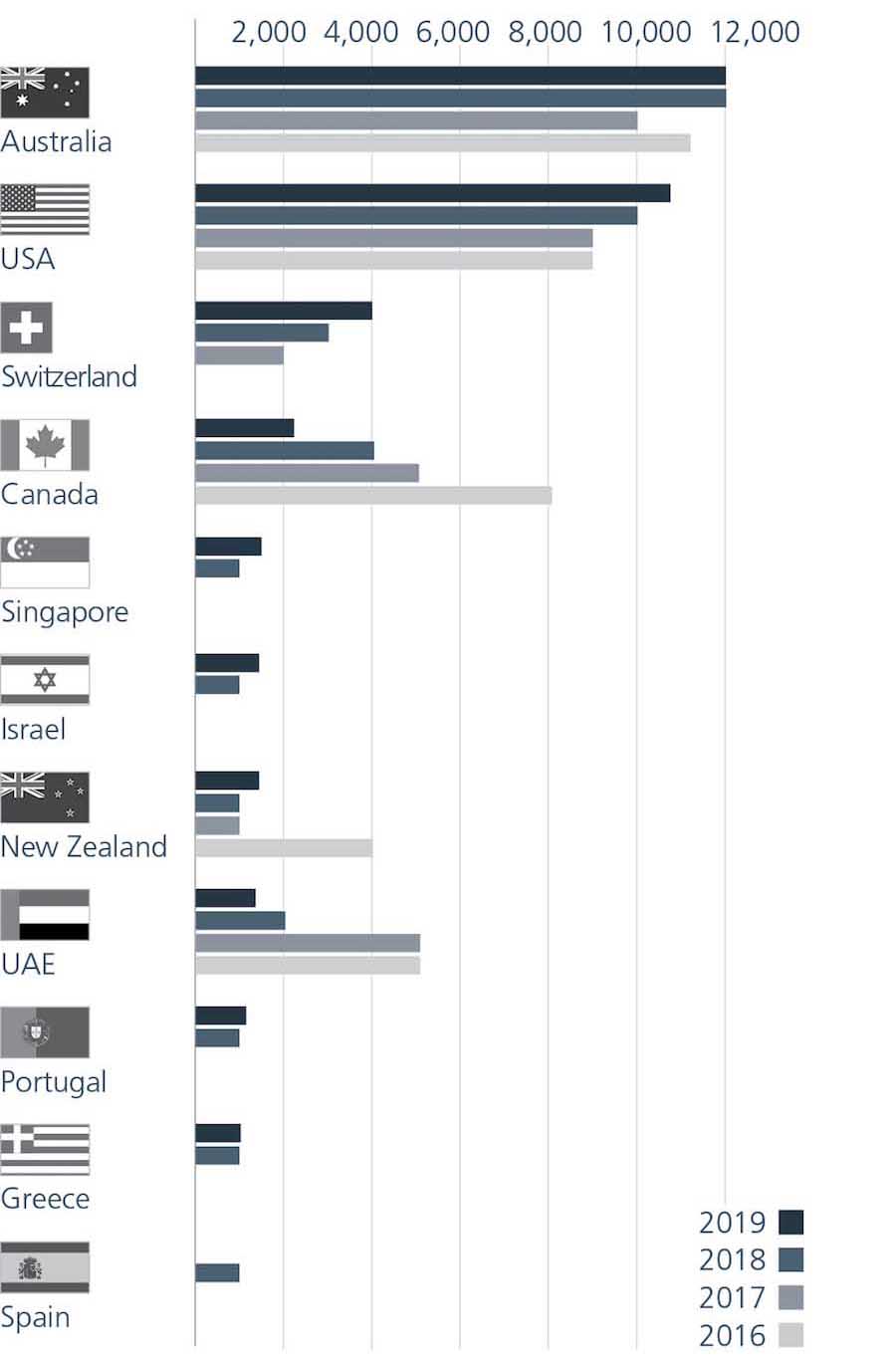

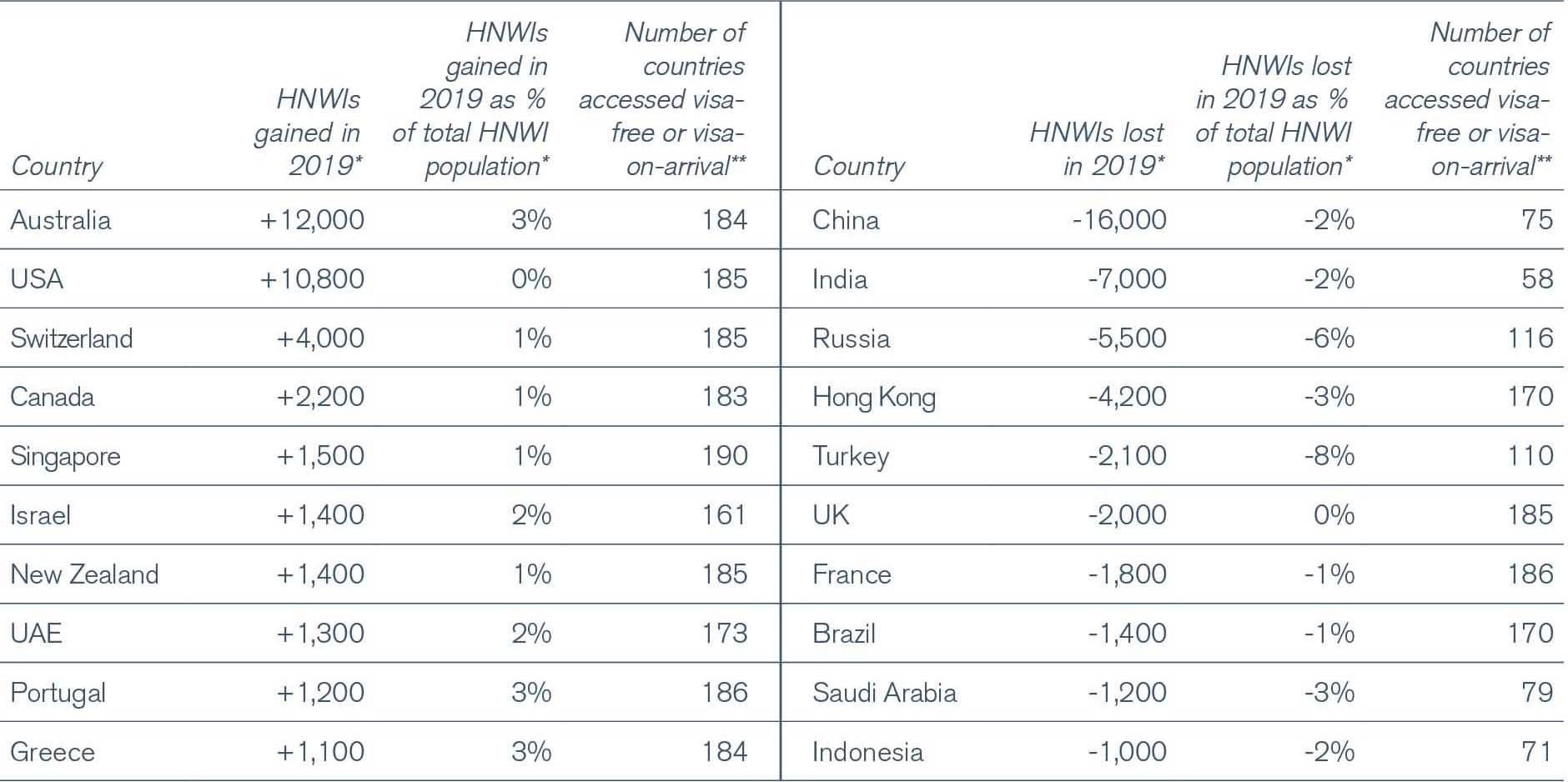

Millionaire Migration Henley Partners

By Analyse The Malaysia S Macroeconomic From 2020 To 2021 Discuss About Under Such Situation What Can The Malaysia S Enterprises Do To Decrease The Loss

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

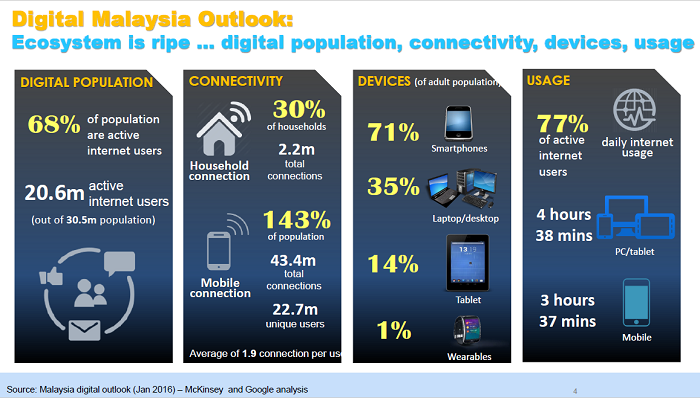

Budget 2020 Accelerating Transition To A Digital Economy Digital News Asia

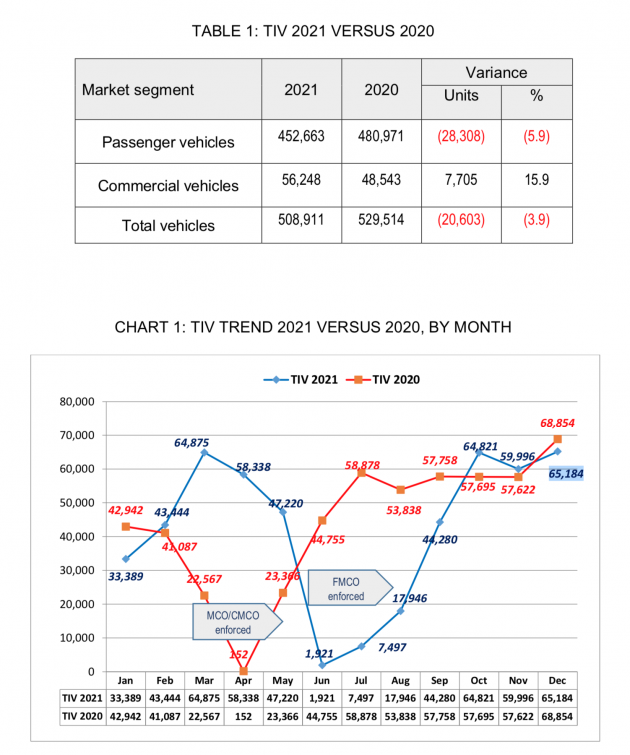

Malaysia Car Sales In 2021 Total Industry Volume At 508 911 Over 20k Down Vs 2020 95k Less Than 2019 Paultan Org

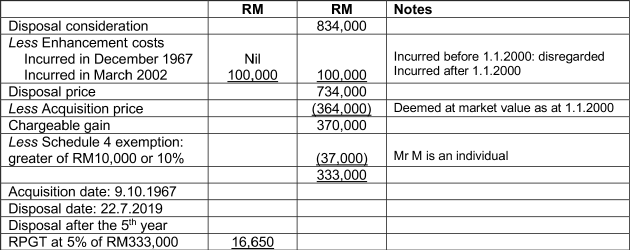

Real Property Gains Tax Part 1 Acca Global

Myhijau Sme Entrepreneur Development Program Malaysian Green Technology And Climate Change Corporation

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

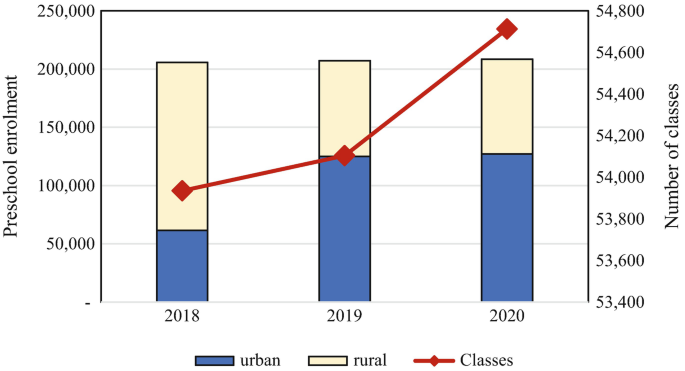

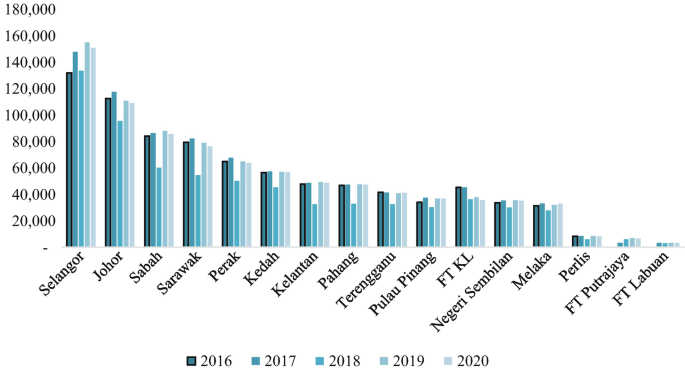

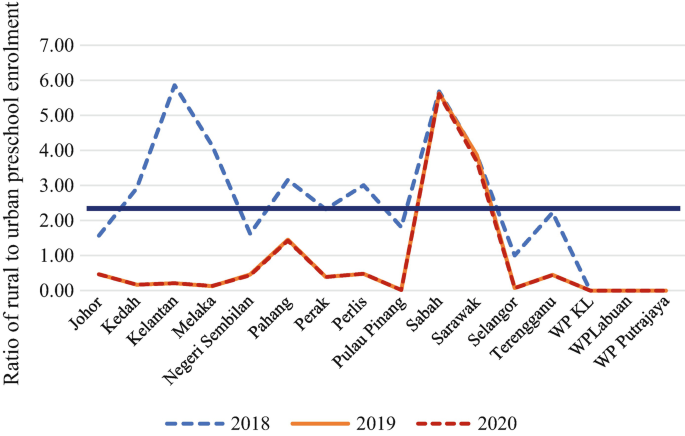

Early Childhood Education In Malaysia Springerlink

Early Childhood Education In Malaysia Springerlink

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Millionaire Migration Henley Partners

Early Childhood Education In Malaysia Springerlink

Tax Relief Ya 2021 9 Things You Should Know When Doing E Filing In 2022

Early Childhood Education In Malaysia Springerlink

Millionaire Migration Henley Partners

Here S 5 Common Tax Filing Mistakes Made By Asklegal My

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience